7 Social Media Trends That Loan Officers Need to Know for 2024

Brandon Treadway

·

7 minute read

Brandon Treadway

·

7 minute read

Every year, right around this time we start to see a lot of lists come out looking forward to the following year.

Social media trends, marketing trends, sales trends, advertising trends.

So many different lists and a lot of opinions.

At SocialCoach we are all about making things easier for loan officers to be publishing on social media and you spending a ton of time reading through social media trends for 2024 isn’t going to make things easier.

So here’s what we did:

We read all of the articles for you and we took the most important social media trends, the ones that we feel like loan officers can really take advantage of, and we compiled them here for you.

2024’s social media trends, but all specific to loan officers.

Let’s get started.

1. Short-Form Video

We might as well get this one out of the way now.

If there is one trend that dominated 2023 and is sure to dominate 2024 as well, it’s vertical short-form video.

In the past, each social media platform kind of had its own “thing” that it did best:

Facebook was about groups and more text-heavy posts with a side of photos.

Instagram was photo-centric.

YouTube was all about videos.

But things have changed.

Now TikTok, Instagram and Facebook Reels, LinkedIn, YouTube Shorts, vertical short-form video is the top performing content on every single social media platform that has embraced it. And for good reason.

Short-form video is easy to digest, engaging to view and easy to interact with as these videos often invite easy commenting and engagement with TikTok and Instagram making “liking” a video as easy as a double tap.

Mortgage Social Media Application

The good news for loan officers is that not only is this the most important social media trend of 2024 that might make or break your social media strategy, but it’s also the easiest to implement.

Taking advantage of this trend is as simple as pulling out a smartphone and recording a video.

Loan officers should prioritize creating content that helps to make the mortgage process easier to understand.

If you need specific help in finding the right kind of content to base your short-form videos around, SocialCoach can help.

Whether you want to learn from some of the best mortgage TikTok accounts to follow or just want a list of mortgage social media ideas, the biggest hurdle is just making that first video.

2. Less Polish, More Authenticity

If there’s one thing that we are seeing more of in terms of social media engagement, it’s a preference for content that feels “real”.

What does “real” mean on social media?

Well, that kind of depends on the viewer of the content, but what most social media users are wanting to see is content that doesn’t feel overly produced.

Something that feels in the moment rather than something that went through a polished creative process.

Where do we see this?

TikTok is a great example of this where you see people simply pulling out their phones and recording themselves.

At most, videos may want to do some simple editing, add captions and transitions and maybe tighten up the timing of the video, but there’s no need for fancy equipment for these videos.

Mortgage Social Media Application

This is actually simpler than it sounds – stop trying to dazzle with the production quality of your videos.

In all reality, what people care most about in your videos is that you are relatable, authentic, and that what you have to share is good enough to watch and engage with.

@thatmortgageguy Replying to @B ♬ original sound - That Mortgage Guy

Should you sit by a window for some decent lighting?

Probably, yes.

Should you use a small microphone?

It’s not essential to get started. Your phone mic is good enough.

But making that video and making your content feel real and authentic is the most important thing going into 2024.

3. User-Generated Content Strategy

User-Generated Content or UGC is content created by regular people about a product or service.

Usually this content is created by customers on their own and the brand is tagged or mentioned in the post.

UGC is generally viewed as less biased and a fairer take on that product or service since it’s not the brand creating that piece of content.

It goes back to the desire for social media to be “more real.”

UGC also gives a real look at the customer or client experience.

For the real estate and mortgage industry, sharing that customer experience can be a potent tool in your social media toolkit.

Mortgage Social Media Application

In order to get more UGC for your social media accounts, work with your clients to have them document their home buying experience on their profiles in a way that you can re-share.

A client that posts about each step of their borrowing experience can be a valuable UGC asset that you can share on your account.

Not only are they sharing their experience in borrowing for a home, but they are sharing their experience buying with you – and that can be a powerful thing for others to see.

Pro Strategy: TikTok Stitches and Duets

Additionally, platforms like TikTok include features like stitching and duets which allow you to incorporate other creators’ TikToks into your TikTok so you can provide either a reaction or additional insight.

Take for example, a TikTok of a millennial talking about how their first mortgage payment breaks down and how much of that goes towards the principal versus interest and escrow.

@yourmortgageguide You can pay off your mortgage in less than 30 years following these steps! #yourmortgageguide #mortgagetips #homebuying #homeowner #mortgagelending #firstimehomebuyer #realestate ♬ original sound - Your Mortgage Guide 🏡

A smart loan officer could stitch that video and talk about how mortgage payments might break down for a first time home buyer. Stitches allow you to add your thoughts at the end of a video while Duets allow you to split-screen a video with yourself on one side.

4. Generative AI

Unless you’ve been living under a rock for the last couple of years, you’ve heard about generative AI – this is your AI tools like ChatGPT.

As you work to create more and more social media content for your audience, one trend we are already seeing that is sure to continue is the use of generative AI in helping to scale social media content production.

But creating your content purely from AI tools like ChatGPT or DALL-E isn’t the best idea.

We’ve already talked about your audience’s desire for real, authentic content.

Mortgage Social Media Application

So where can you use these tools in a way that helps you and doesn’t hurt you?

A great way to leverage Generative AI is in the planning of social media content.

Asking ChatGPT to list out topics to cover, terms to define, or questions that home buyers might have is a great way to collect ideas for future social media videos.

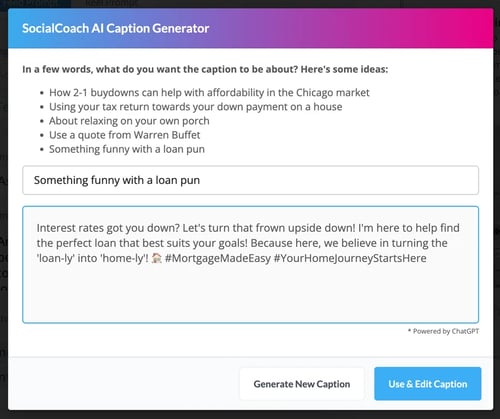

Another AI application is caption generation.

After you take all of the time and effort to create your video, let AI run with the ball and create a caption for your post. SocialCoach makes this easy with our mortgage-specific AI tool (seen below).

If you are really wanting to dig in and use AI to your benefit, check out our article breaking down how loan officers can use AI in their social media strategy.

5. TikTok and LinkedIn

If there are two social media platforms that are poised to dominate this year it’s TikTok and LinkedIn.

TikTok is certain to dominate in B2C marketing while LinkedIn is ideal for professionals to reach each other.

TikTok continues to grow as a social media platform.

It’s popularity doesn’t seem to be waning at all like other platforms like Facebook and Twitter (or X) and it’s style of content fits right into what’s trending.

In fact, it might be more accurate to say that the content on TikTok is dictating what is trending for 2024.

The platform is loaded with content that is real, off-the-cuff, unscripted and insightful.

It provides very simple ways for creators to engage with their audiences and elevate conversations into additional content.

LinkedIn on the other hand is going through a bit of a shift as well.

With algorithm changes last summer, LinkedIn went from a platform that was seemingly designed to be exploited to go viral to one that actively seems to suppress virality in favor of personality.

LinkedIn is going from pushing brand, to pushing human engagement.

While many of the trend articles talk about the value of CEOs becoming more of a social engagement face of the company, mortgage lenders can take a different approach to LinkedIn in 2024.

Mortgage Social Media Application

If you aren’t creating short-form video for TikTok, then you are only falling further and further behind.

The platform is a treasure trove of content for home buyers and there are plenty of mortgage creators already drawing a ton of loan business from the platform.

Using the platform to inform and answer questions about mortgages is the best way to take advantage of this trend and become a trusted name in the mortgage space.

As far as LinkedIn is concerned, we see a lot of loan officers posting content on LinkedIn that might be better suited for TikTok, but LinkedIn is a great place for finding connections with real estate agents and occasionally finding home buyers.

It’s important to remember that on LinkedIn, you’re mostly talking to your own network – people that you have rubbed shoulders with.

So finding ways to let them know you’re available is the key on LinkedIn.

6. Engagement and Awareness

It’s important to remember that the real benefit of social media when it comes to marketing isn’t only leads.

Sure, leads and business are the end goal of any marketing effort, but what you are wanting and what your audience wants is engagement.

When you post something on TikTok or LinkedIn, the expectation should not be that you will get business from that post.

Rather, you should be posting with the goal of creating a dialogue and engaging with your audience.

The more you can engage, the more that your audience will engage back.

That engagement will also help to bring awareness of you and what you offer to people outside of your social circle of influence.

Nearly every social media platform now is focused around promoting content that results in engagement.

Mortgage Social Media Application

If you want to be viewed as a trusted loan officer on social media, building relationships through engagement is of paramount importance.

Engagement is simple – every comment provides an opportunity to have a conversation with a member of your audience. Try to keep conversations going in the comments with questions and answers.

-2.png?width=500&height=780&name=Untitled%20design%20(6)-2.png)

A comment of “great video!” can easily be turned into a conversation by asking the commenter what part of the video they think they can apply to themselves.

A back and forth conversation like this not only improves the relationship that you have with your audience, but it will also boost the awareness that others have of your post.

Social media platforms want to push high-engagement posts onto as many feeds as possible.

7. Experimentation

As you publish content and you start to figure out what works for you, it’s important to keep trying new things. 2024 is the year of experimentation with your content.

It’s all about finding your 80/20 mix – that is, 80% of your content should be your bread and butter that gets you views, with 20% of your content trying out a new style, new trend or new angle.

Experimentation is crucial for a number of reasons, namely that it prevents your content from becoming stale.

But oftentimes experimenting with your content can result in a boom of engagement and followers, resulting in a now larger pool that you can sent that remaining 80% of content to.

Mortgage Social Media Application

If you are creating content that is mostly you discussing mortgage terms or targeting education-style content, you might try going for a skit about a recent conversation that you had where a borrower threw a curveball your way.

As you experiment with different types of content, you’ll find more and more types of content that your audience connects with and you can add it to your toolkit of social media.

Stay On Trend with Video Catalyst

With these trends facing loan officers in 2024, it's important that you find a way to stay on top of these trends in a time-efficient way.

With Video Catalyst from SocialCoach, loan officers get 4 scripts monthly to film for their social media accounts. Just record and send in your 4 videos and SocialCoach's team of professional editors create a social media-ready video for your social profiles.

Click here for a demo of Video Catalyst and see how it can benefit you and your mortgage business.

-01-1.png?width=1200&height=238&name=Logo%20-%20Social%20(V001)-01-1.png)